AgencyProfit апликација која им помага на агенциите да бидат профитабилни

За основачи на дигитални, креативни и маркетинг агенции во EU, UK и APAC кои скалираат од $500K до $2M приход

Фрустрирани од непредвидлив cash flow, P&L извештаи што покажуваат профит додека нивната банкарска сметка е празна, постојано исплаќање на себе последни (или воопшто не), стрес во даночната сезона поради недоволни резерви, и рачната мака од следење на Profit First allocations во spreadsheets

AgencyProfit.app е фокусирана Profit First cash allocation алатка која ја имплементира ортодоксната 5-account методологија на Mike Michalowicz (Income, Profit, Owner Pay, Tax, OPEX) специјално дизајнирана за agency business models

- За разлика од официјалната Profit First App која бара US банкарски сметки преку Plaid и не функционира за EU/UK/APAC агенции

- За разлика од Agicap која таргетира €5M+ компании со enterprise pricing и комплексни treasury features

- За разлика од Scoro и Productive.io кои се сеопфатни agency management suites без Profit First-специфична allocation логика

- Моментална предгледност во тоа каде секој pound/euro/dollar треба да биде алоциран базирано на докажани Profit First проценти

- Конзистентна owner pay преку автоматизирано allocation tracking и bi-weekly distribution reminders

- Нула стрес во даночната сезона со dedicated tax reserve tracking и quarterly deadline alerts

За да можат основачите на агенции конечно да престанат да живеат од плата до плата, да си исплаќаат прво на себе со доверба, да го елиминираат стравот од даночната сезона, и да градат вистински профитабилни бизниси наместо само зафатени

$20,000 - $40,000 MRR

2 weeks

Digital, creative, and marketing agencies in the EU, UK, and APAC regions with $500K-$2M annual revenue.

Проблемот

Сопствениците на агенции постојано пријавуваат дека нивниот P&L покажува профит, но нивната банкарска сметка е празна или во минус. Си исплаќаат последни (или воопшто не), се плашат од даночната сезона затоа што немаат одвоено доволно, и немаат visibility во тоа што можат безбедно да потрошат. Profit First методологијата го решава ова преку бихејвиорална cash allocation низ повеќе банкарски сметки, но рачното имплементирање преку spreadsheets е досадно и подложно на грешки. Постоечките решенија или таргетираат enterprise компании (Agicap за €5M+ приход), бараат скапи bank integrations, или се фокусираат на cash flow forecasting наместо на специфичната Profit First allocation методологија. Сопствениците на агенции во опсегот $500K-$2M се underserved - премногу големи за DIY templates, премали за enterprise алатки.

Реални луѓе кои го искусуваат овој проблем

Brian Walker

"Every month when I would go through my financials, the P&L would show me that I'd made a profit. I would look down at the bottom line and it would show me how much money I'd made, but where was it? It certainly wasn't in my bank account. All of these years, I'd missed the fact that debt payments, taxes, and distributions didn't show up on the P&L."

AgencyAnalytics Blog

AgencyAnalytics Blog

Dave Fedoroff

"Some months, our P&L showed a profit of 7% but my account was overdrawn $300. So we didn't really profit 7%. Now that we're using Profit First we know the exact number that we're profiting every month."

🔗 Mike Michalowicz BlogBrian Walker

"I'd been on a payment plan with the IRS as long as I could remember. I hated the IRS. I loathed taxes. I actually had fear and a sense of dread when I would hear those 3 letters."

AgencyAnalytics Blog

AgencyAnalytics Blog

Jason Swenk (interviewing Mike Michalowicz)

"So many agencies are living check to check. They're most concerned with top-line revenue instead of profitability. Are you constantly struggling with cash flow? Do you always pay yourself last, or not at all?"

🔗 Jason Swenk PodcastSophia Sunwoo

"When I was building my second startup, I got into a never-ending cycle of not paying myself — every month, I'd pay off my monthly subscription for my website, accounting software, and any outstanding expenses... I had a naive perception of startup cash flow back then — I believed that cash flow would flow in predictable, sizable chunks between the 1st and 31st of every month."

Medium (The Startup)

Medium (The Startup)

Lauren Leader

"When I was freelancing on the side of my full-time job, I had no idea what my profit was. I had no idea how much to put aside for tax and long-term expenses. Like so many freelancers and business owners, tax time was a source of stress for me, as I just hoped I had the money to pay what I owed."

🔗 Lauren Leader Studio BlogPaige Brunton

"When we look at a 50k bank balance, we feel like ballers, and then begin to spend like ballers... Only to realize later that 40k of that was really saved for taxes and now that we just balled out on a new laptop, camera, conference ticket, and team member... we're actually indebted, even though there's still 30k in the bank. Whoops!"

🔗 Paige Brunton BlogAnonymous Creative Agency Owner (D&K Accounting Case Study)

"A thriving creative agency, generating a turnover of over £2.5 million annually, appeared successful from the outside. However, beneath the surface, financial chaos reigned. The owner was stuck in a cycle of inconsistent cash flow, struggling to pay suppliers on time, and feeling the strain of late tax bills. Personal pay was often sacrificed to cover business costs, leading to burnout and frustration."

🔗 D&K Accounting UKПазарни Сигнали

Големина на пазар

Global agency financial software market for agencies in $500K-$10M revenue range. Approximately 200,000-300,000 agencies worldwide with average potential spend of $1,200-$6,000/year on financial tools

Трендови на пребарување

Loading chart...

Конкуренти

Profit First App

$19-$100

The official technology platform endorsed by Profit First creator Mike Michalowicz, designed to automate the Profit First cash management methodology for entrepreneurs.

Слабости

- • Very new product (Version 2.0 launched April 2025) with limited track record

- • Automated allocations only work fully with Dream First Bank accounts

- • Plaid integration US-only - limiting EU/UK/APAC users significantly

Profit First Spreadsheet Templates

$5-$30

Low-cost, DIY cash allocation templates based on Mike Michalowicz's Profit First methodology, enabling small business owners to implement the profit-allocation system without ongoing software subscriptions.

Слабости

- • Manual data entry required - no bank integrations or automations

- • No real-time visibility - static snapshots only

- • Defeats methodology purpose according to Mike Michalowicz himself

Pulse

$29-$89

Focused cash flow management and forecasting tool for small businesses, designed to replace spreadsheets with simple visualization of income, expenses, and cash projections.

Слабости

- • UI needs improvement and more user-friendly design

- • Manual data entry required - no bank integrations on basic plan

- • No live customer service - only online help center

Agicap

Custom - quote required

Europe's leading all-in-one cash flow management and treasury platform for SMBs and mid-market companies, automating financial workflows and providing real-time visibility over cash positions.

Слабости

- • Bank connection instability - data appearing twice, breaking connections

- • Limited customization for specific business needs

- • Manual adjustments required for automatic categorizations

Fathom

Tiered pricing ($20-$35)

Financial analysis, reporting, and forecasting platform that transforms accounting data into visual reports and KPI dashboards for businesses, accountants, and advisors.

Слабости

- • Limited forecasting capability - basic tools, no custom formulas

- • Steep learning curve for new users, slow implementation

- • Feature rollouts have been slow in recent years

Float

$50-$115

Cash flow forecasting software for small-to-medium businesses that integrates with Xero, QuickBooks, and FreeAgent to provide visual forecasts and scenario planning.

Слабости

- • Expensive relative to accounting software ($50-115+/month)

- • Limited advanced forecasting - no P&L or balance sheet projections

- • Requires accounting software to be constantly reconciled for accuracy

Productive.io

$9-$32

All-in-one agency management and professional services automation platform built specifically for agencies, consultancies, and service businesses with integrated project, resource, and financial management.

Слабости

- • Bugs in critical modules like timesheets and invoicing

- • Reporting numbers inconsistent across platform

- • US support delays since team is in Europe

Relay Financial

$0-$90

The official banking platform for Profit First, offering fee-free business banking with up to 20 checking accounts designed for envelope-style cash management and allocation strategies.

Слабости

- • Account freezes and aggressive fraud prevention causing business disruptions

- • No physical branches - purely digital banking

- • Customer support limited to 9-5 EST with slow response during issues

Scoro

$19-$50

All-in-one professional services automation (PSA) platform for agencies, consultancies, and professional services firms combining project management, CRM, quoting, invoicing, and reporting.

Слабости

- • Expensive - 5-user minimum means $99.50/month entry point

- • Steep learning curve to fully set up and learn all features

- • Limited mobile app functionality

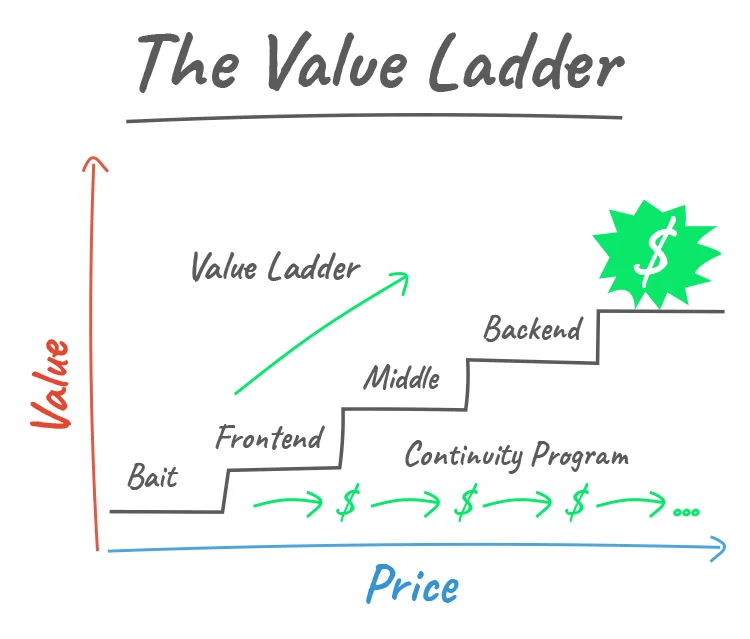

Понуда (Скала на вредност)

Free web-based calculator that takes real revenue, determines optimal Profit First percentages for their agency size, and shows the gap between current and target allocations

$0 (email required)Agency owners input their annual revenue, current profit margin, owner pay, and estimated tax rate. Calculator instantly shows their Current Allocation Percentages (CAPs), Target Allocation Percentages (TAPs) based on Profit First methodology, and a 90-day roadmap to close the gap. Results delivered via email with option to use interactive version.

Immediate clarity on where money should be going. Creates 'aha moment' when owners see the gap. Establishes authority and demonstrates methodology.

Basic Profit First tracking with 5-account system, manual income entry, allocation recommendations, and monthly distribution reminders

$9/month (annual) or $12/month (monthly)Entry-level plan for solopreneurs and micro-agencies testing the Profit First waters. Includes single-user access, 5 standard Profit First accounts, manual income logging, automatic allocation calculations, bi-weekly distribution reminders, and basic reporting dashboard. Limited to $100K annual revenue.

Replaces spreadsheet tracking with purpose-built tool. Removes guesswork from allocation percentages. Creates accountability through reminders.

Full Profit First implementation suite with unlimited revenue, multiple users, custom allocation percentages, historical tracking, tax preparation reports, and owner pay optimization

$29/month (annual) or $39/month (monthly)Complete Profit First toolkit for agencies serious about profitability. Includes 3-user access, unlimited revenue tracking, customizable CAPs and TAPs, historical allocation analysis, quarterly distribution optimization, tax reserve tracking with deadline reminders, owner pay consistency scoring, export to accountant, and priority email support.

Complete financial clarity for agency operations. Reduces tax-time stress to zero. Enables consistent owner compensation. Provides data for business decisions.

12 months of Growth Plan at discounted rate plus bonus onboarding call

$249/year (save $99 vs monthly - 28% discount)Annual commitment to Growth Plan with bonus 30-minute onboarding call to set up accounts and allocation percentages correctly. Includes all Growth Plan features plus early access to new features and annual profit review template.

Locked-in savings. Personal onboarding ensures correct setup. Demonstrates commitment to methodology.

Рамката на Russell Brunson за структурирање на понудите. Почни бесплатно, изгради доверба, потоа понуди поголема вредност на повисоки цени.

Lead Magnet

Бесплатна вредност за градење доверба и собирање лидови.

Frontend Offer

Продукт со ниска цена за конвертирање лидови во клиенти.

Core Offer

Главниот продукт или услуга. Најголем дел од приходот доаѓа од тука.

Backend Offer

Премиум понуда со висока цена за најдобрите клиенти.

Зошто функционира: Градиш доверба на секој чекор. Кога некој ќе стигне до највисоката понуда, веќе те познава и ти верува.

Научи повеќе за Скалата на вредност во книгата на Russell Brunson · Russell Brunson

Ние го направивме истражувањето. Сега гради.

Почни да градиш со 1 кликИстражи ја твојата идеја.

Добиј ист извештај за твојата идеја. Конкуренти, проблеми, пазарни сигнали, скала на вредност, промптови за градење. Автоматски.

Анализа на вредност

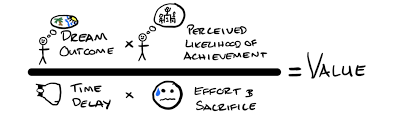

Рамката на Alex Hormozi за разбирање дали идејата ќе биде лесна за продажба. Повисок резултат = полесна продажба.

5.4/10

↑ Максимизирај ги овие

Agency owners achieve financial clarity, pay themselves consistently, never stress about taxes, and finally feel 'profitable' rather than just 'busy'. However, this is organizational clarity (vitamin) not urgent pain relief (painkiller).

Profit First methodology is proven and endorsed by thousands. Simple manual entry MVP means low technical friction. However, success depends heavily on user discipline - tool can't force behavioral change.

↓ Минимизирај ги овие

Financial clarity begins immediately upon setup. However, true results (stable owner pay, tax reserves, profit distributions) require 3-6 months of consistent use. This is not instant gratification.

Manual income entry requires ongoing effort (5-10 min per transaction). Must open 5 bank accounts. Some friction in changing existing financial habits. However, significantly easier than spreadsheet tracking.

Формулата на Alex Hormozi од $100M Offers. Колку е повисок резултатот, толку полесно се продава понудата.